Digital Language Training as a Fringe Benefit

High inflation and talent shortage mean the issue of pay raises have become a hot topic for HR professionals around the globe. Understandably, companies are struggling with the best way to respond.

Enter employee language and communication skills training as a tax-free fringe benefit for your entire workforce.

Why Speexx as a Tax-Free Fringe Benefit?

Many businesses provide language education as a fringe benefit so their employees can improve their communication skills and gain additional knowledge. In most countries this perk is tax-free and an attractive alternative or addition to taxable pay-raises. Talk to your Speexx consultant to find out if tax exemption for employee language training applies to your country.

Why Speexx? Language skills are one of the few coaching topics that apply to almost everyone in an international organization. Plus, you want to be sure that a fringe benefit brings real value to your co-workers. Speexx has as a 98% user satisfaction rate and has been recognized as the #1 digital language training platform on the popular review platform G2.

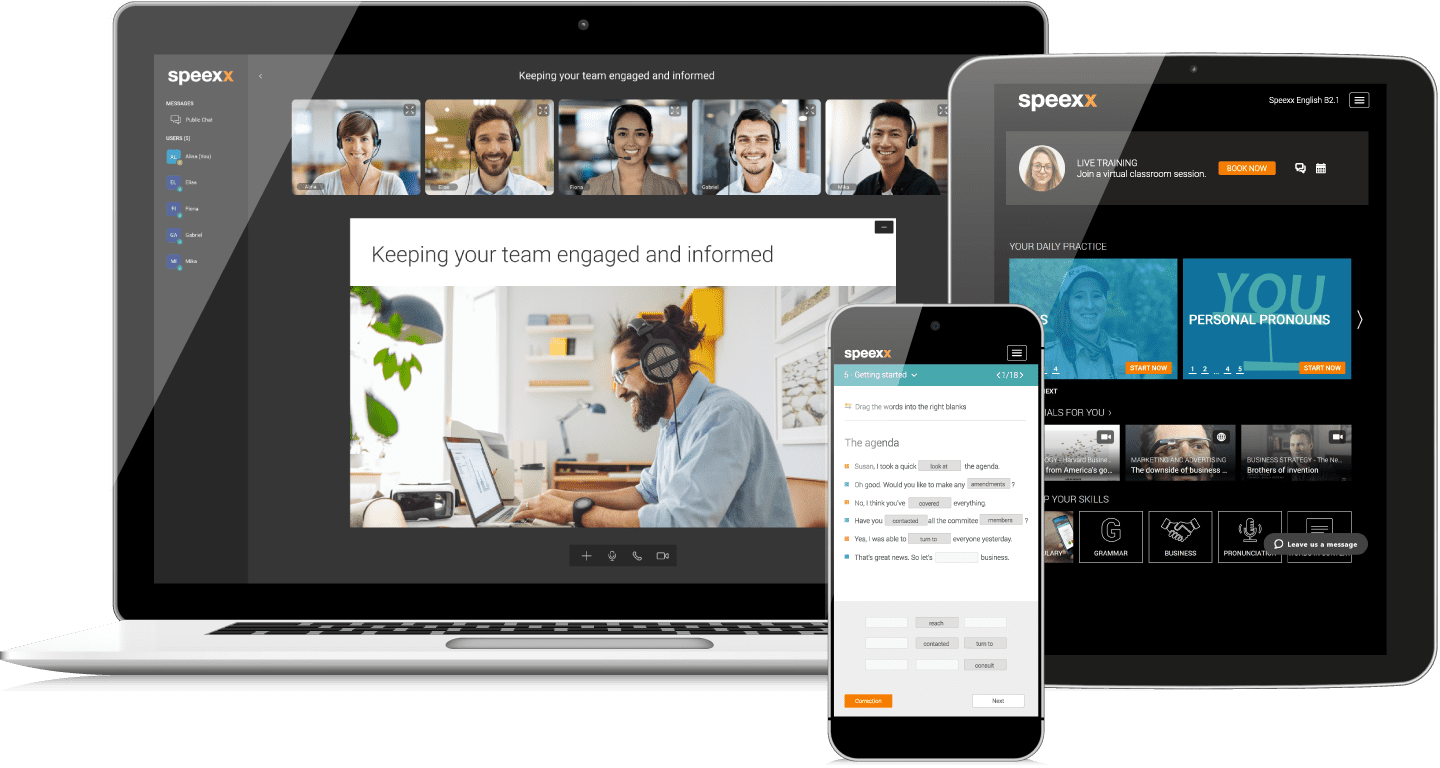

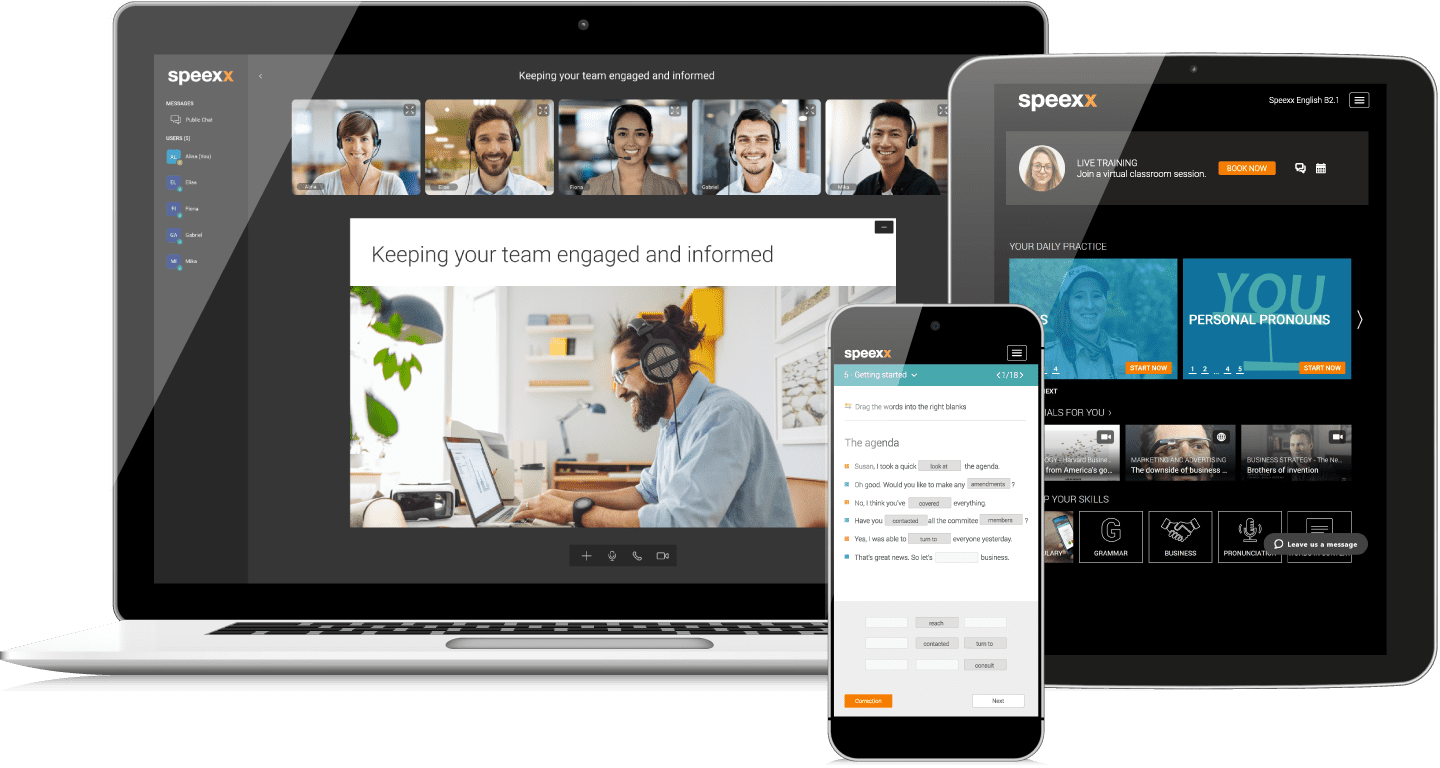

Speexx is the ideal platform for providing communications skills training as a fringe benefit. The digital platform brings you a brand new, learner-centric focus within a global training solution for the hybrid workplace.

Simon Sinek, Optimist and Autor

“When people are financially invested, they want a return. When people are emotionally invested, they want to contribute.”

Simon Sinek, Optimist and Autor

Our Clients Love Us

We are proud that G2 has ranked us not only as a Language Learning Leader, but a High Performer across various categories for educational technology. But best of all: Users Love Us!

4.7 out of 5

Drive Digital Transformation with Tax-Free Education

When you provide digital training as a fringe benefit, you will want employees to love to learn on your platform. That way, they will appreciate the benefit they are receiving, whilst developing their own skillsets and raising their performance level. Speexx’ modern user interface and AI-driven personalization technology means we drive high levels of user engagement and satisfaction. Speexx helps you push the right curriculum or micro-learning content at precisely the right place and moment in time.

And, of course, the platform provides measurable and actionable insights that help you quickly assess which programs are effective and which activities influence the best results.

Drive digital transformation and support the transition to the hybrid workplace with Speexx. Grow the adoption of digital learning with AI and smart algorithms.

Are Fringe Benefits Subject to Income Tax?

Some of the most common fringe benefits like health and life insurance or workplace training and education are not taxable in most countries but others are taxed at what is called fair market value. The exemption for work-related training covers the costs borne by the employer. It includes the whole range of practical or theoretical skills and competencies your employees are reasonably likely to need in their present or likely future jobs with your organization.

Check with your Speexx training consultants which rules apply for your country.

Perfect Integration for Training as a Benefit

If you want training as a fringe benefit to be accessible for everyone, ask for deep integration into your existing IT environment. Speexx has 15 years of experience with integrating digital language training into HR workflows and technology. Let´s not forget: providing training opportunities to your workforce is only half the battle. It’s also about the internal roll-out, integration with existing technology, service delivery and overall user experience. Leading LMS and LXP providers, including Cornerstone OnDemand, Oracle, SuccessFactors OCN, Saba, Docebo and many more trust in Speexx to provide the best native language learning and skills testing experiences for their users.

Is Digital Language Training a Fringe Benefit?

Language and communications skills training is among the most popular tax free fringe benefits in large organizations across the world. In the US, employers can offer employees $5,250 of educational assistance tax-free each year (IRS, 2020). In the United Kingdom employer-provided retraining is exempt from Fringe Benefits Taxation (FBT). In 2020, the Australian government gave a boost for skills training with FBT exemption. In Germany ( § 3 Nr. 19 EStG), Austria, Switzerland, and most EU countries employer borne reskilling, upskilling and training are tax-free for employees.